No valid VAT code could be determined

Automatically translated

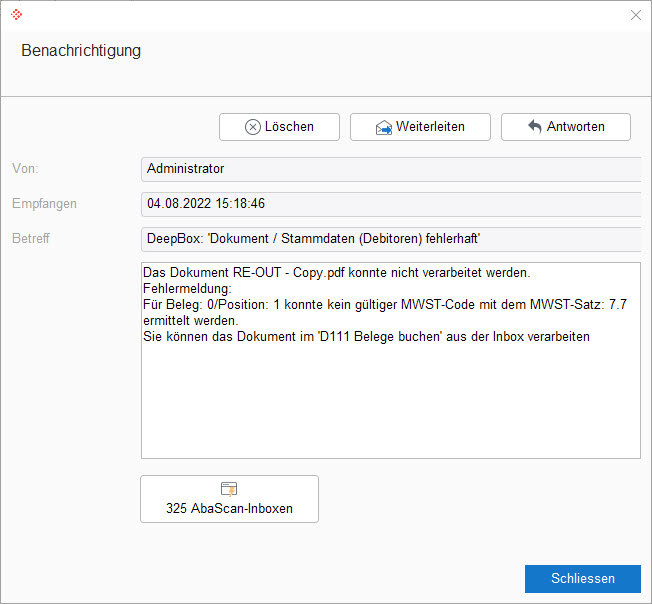

Error message: “No valid VAT code with the VAT rate: 7.7 could be determined for voucher: 0/item: 1.”

The following error message appears if the VAT references are not set in the “621 Application settings” program.

You can set this under “621 Application settings > Abacus Toolkit > VAT references”.

Did this answer your question?

Related articles

Are the VAT references set in "621 Application settings"?

If a receipt is processed via the DeepBox, the VAT code is determined in accordance with the linked article “VAT code determination process”. Client subject to VAT If ...

Document processing for clients not subject to VAT

The following settings must be made in Abacus when processing receipts from clients not subject to VAT via the DeepBox: If vouchers with VAT are now analyzed in the editor, the VAT...

Is the VAT base and VAT amount automatically recalculated on the DeepBox?

No, the VAT base is not automatically recalculated at the moment. However, it is being examined whether this is possible in the future.