Positions / VAT tab

Automatically translated

Recognition of VAT / positions

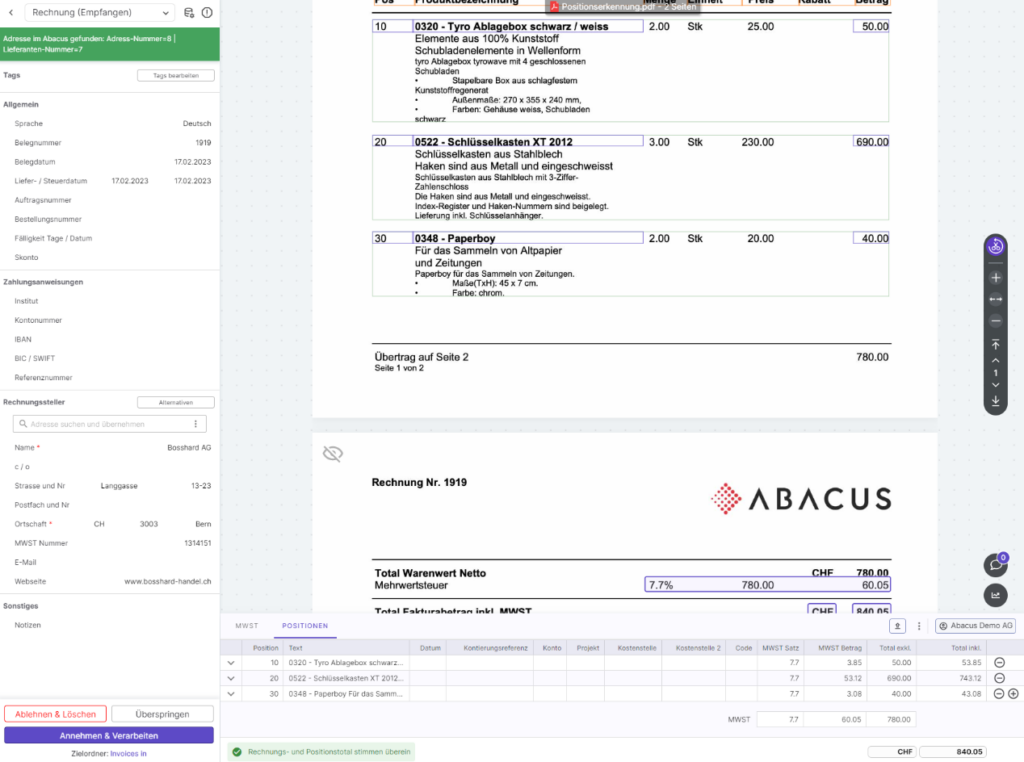

VAT recognition is used by default in the Advanced boxes. With this recognition, one item is created for each VAT rate recognized, regardless of the number of items on the invoice.

Sample calculation

POS 1: incl. 7.7% VAT

POS 2: incl. 7.7% VAT

POS 3: incl. 2.5% VAT

Position creation in the VAT tab

POS 1: Total of POS 1 + 2 from the invoice

POS 2: POS 3 from the invoice

During position recognition, one position with the respective position total and VAT rate is created for each recognized line on the invoice. This enables a more precise account assignment at position level without having to create splitting position manually. In addition, further booking details can be entered per position instead of across all positions. For example, an position text can be entered or different cost centers can be defined.

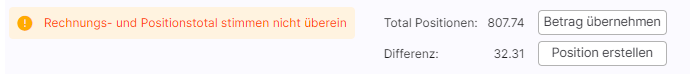

Position recognition informs the user if the invoice and position totals do not match. The user then has two options.

- Either the new total is adopted

- Or a position can be created with the difference

If an position is created manually, the amounts on the position are calculated automatically. For example, an additional position with an amount of CHF 20.00 excluding VAT is to be created with a rate of 7.7%. The position total (amount incl. VAT) and the VAT are calculated based on the information provided.

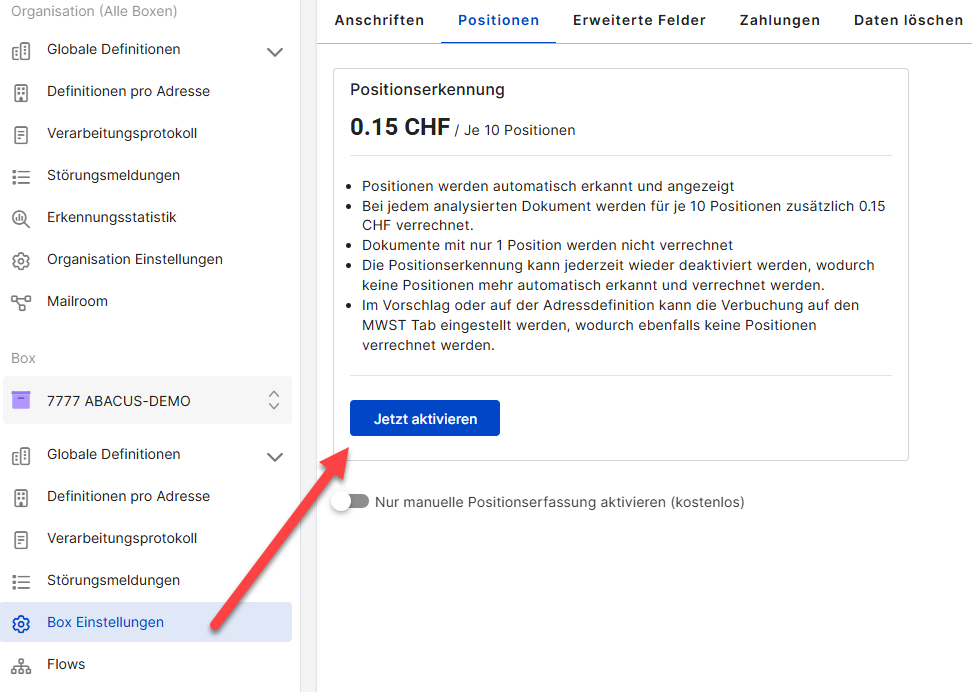

Activation

Position detection must be subscribed to for each box in the DeepO settings. At least one Compact subscription is required for activation.

- Jump to DeepO settings

- Open the “box Settings” tab

- Open “Positions” page

- Click on “Activate now”

Did this answer your question?

Related articles

Switching between VAT and position tab per supplier in the DeepO Editor

In the DeepO Editor, you can set for each supplier whether the VAT tab or the item tab appears by default when opening the invoice in the DeepBox inbox. There are three ways to set...

Train DeepO

All fields in the DeepBox can be filled manually. The “Train DeepO” function can be used to automate the filling of the fields. Activation To be able to use the ...

DeepO recognition behavior

Address recognition There are some factors for the recognition of addresses that are weighted higher for DeepO.For example, data from a QR code or ZUGFeRD is given preferential ...