Recommended table structure for better table recognition

Automatically translated

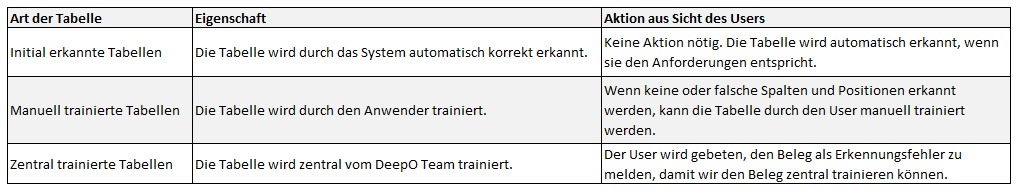

We make the following distinction when recognizing positions:

Initially recognized tables:

To ensure that tables are initially better recognized by the system, the following recommendations apply:

Clear table structure

- No nested tables: no combination of several tables in one block

- No combined cells

- No disruptive graphic elements: (account assignment) stamps, logos and other graphics within the table

Columns

- The individual columns of the table require a column heading

- Homogeneous content per column: Each column should only contain one type of data: e.g. only numbers, only text, only dates.

Lines

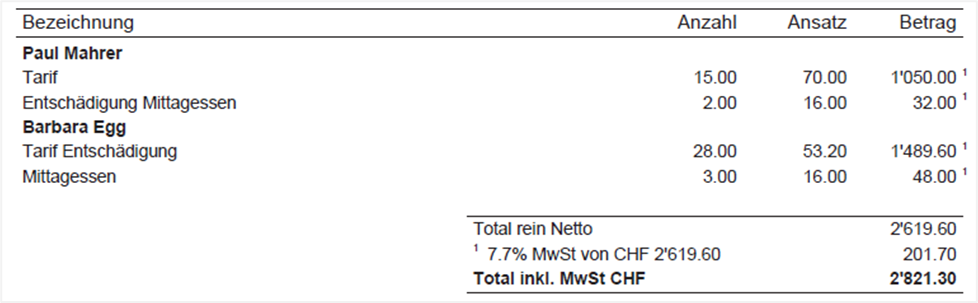

- If an item in a column has no content, this may indicate a “row group”. In such cases, an attempt is made to output the relevant items and include the “group title” in the respective item:

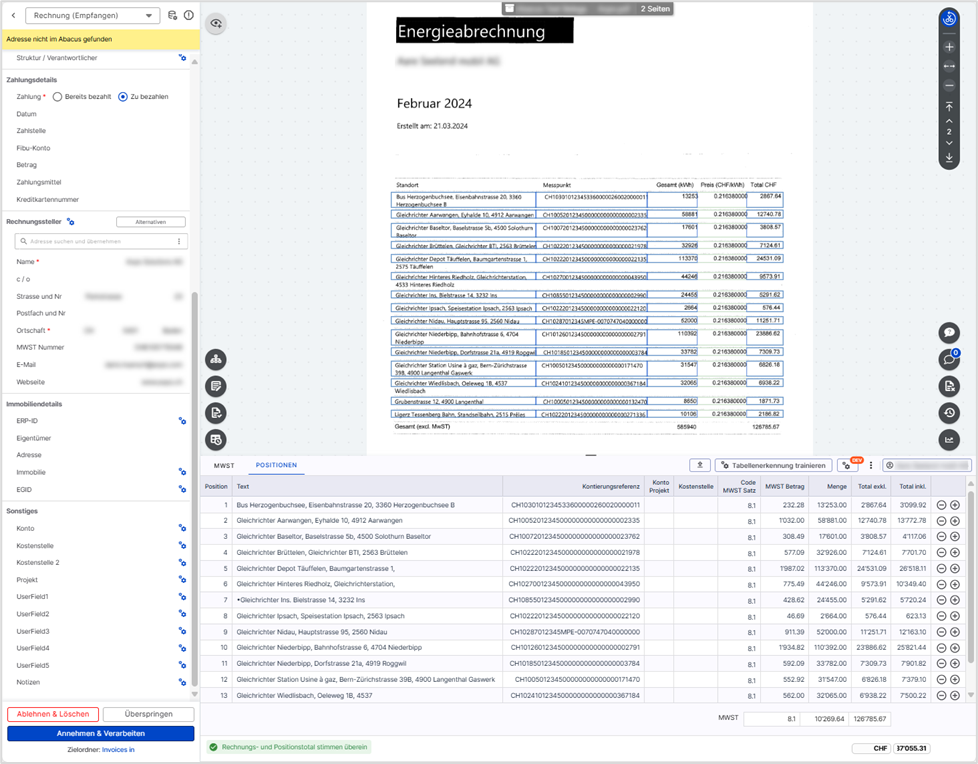

Table according to invoice:

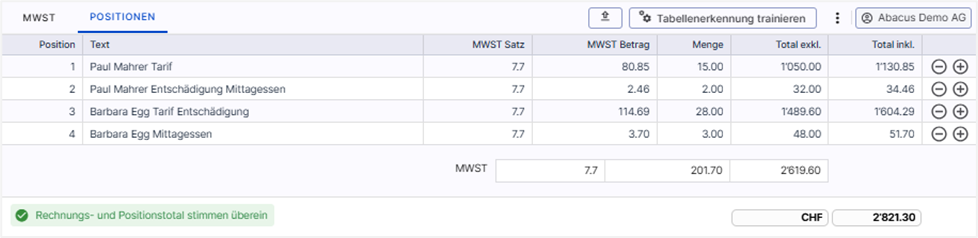

Recognized positions:

Cross-page tables

- For cross-page tables, a column header is required on each page (in addition to the above requirements)

Manually trained tables:

If a table for a specific invoice issuer is not recognized correctly, it is possible to configure it manually. The configuration is saved on the address definition and can help to better recognize documents with the same layout from this sender in the future.

Important

This function only supports simple, consistent layouts that meet the requirements for initially recognized tables. With this tool, the user can, for example, map recognized columns to specific fields – such as defining a recognized column as “position text”.

Complex, widely varying or incorrect table layouts cannot be reliably covered by manual training. In such cases, centralized training can help to improve detection – but even this does not guarantee detection.

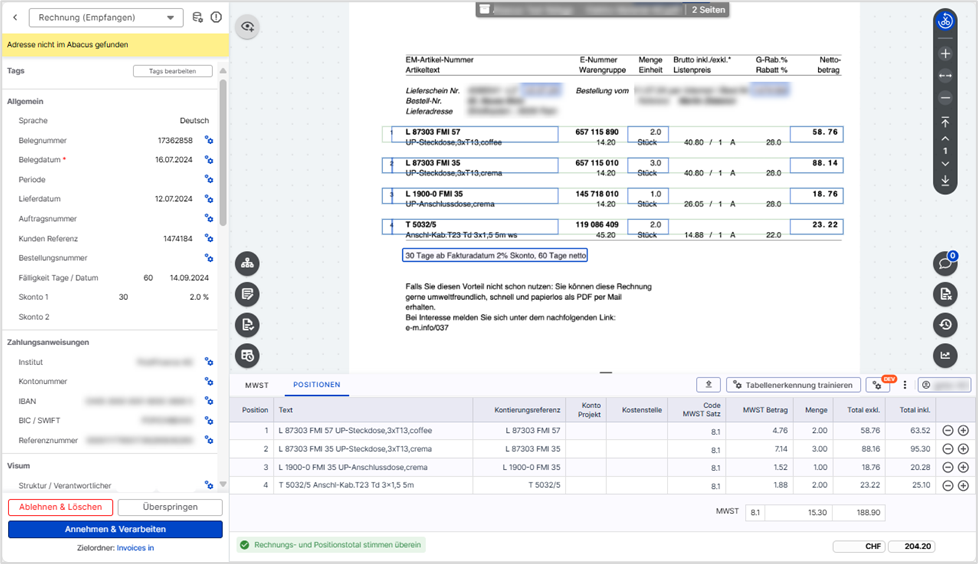

Centrally trained tables:

Some well-known billers that are widely used throughout Switzerland use tables that do not comply with the above specifications. For such common billers (e.g. Swisscom, social insurance companies, etc.), the tables are specifically trained by us. This makes it possible to train those tables that do not meet the requirements for the initial analysis.

Examples:

We ask customers to report such documents to us via a “recognition error” so that they can be trained centrally.

Did this answer your question?

Related articles

Train DeepO

All fields in the DeepBox can be filled manually. The “Train DeepO” function can be used to automate the filling of the fields. Activation To be able to use the ...

Positions / VAT tab

Recognition of VAT / positions VAT recognition is used by default in the Advanced boxes. With this recognition, one item is created for each VAT rate recognized, regardless of the ...

Switching between VAT and position tab per supplier in the DeepO Editor

In the DeepO Editor, you can set for each supplier whether the VAT tab or the item tab appears by default when opening the invoice in the DeepBox inbox. There are three ways to set...